Trump Tax Plan: A Morally Bankrupt President's Gift?

Are Billionaires Trump & Murdoch Bilking America's Unborn Babies?

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC.

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC.

Like many of you, I have been watching the Trump Tax plan make its way through Congress. While Trump and his cohorts were whipping together the tax package, I was doing research on the possible implications of some of their tax policy proposals.

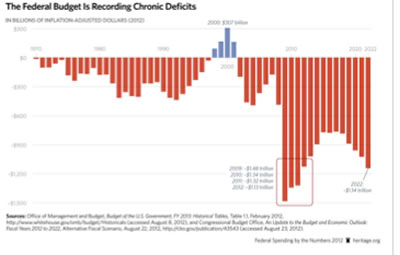

According to an October 20, 2017 PolitiFact report [based on the plan at that time, which has since been modified],

"... in the first year of changes, the top 1 percent are projected to draw a little over half the tax savings. The threshold of 80 percent going to the top 1 percent is projected for the tenth year."

While directionally this statement is likely to hold [meaning the plan is biased toward the rich], the exact numbers as to how biased the Trump Tax Plan will be for the wealthy - based on the final bill - remains to be calculated.

In this report we look at a number of tax cuts included in the final bill including repatriation of overseas profits, reduction of the estate tax, reduction of the corporate tax and the blue vs red state tax increase. We include a review questioning why the Trump Administration is pushing this deficit expanding / debt increasing fiscal stimulus package - when we're in a full employment economy with rising wages. We also include how the Trump Tax Cut Plan has been treated propagandistically by Rupert Murdoch's media outlets, as he appears to personally and corporately benefit immensely from the tax cuts.

But before we begin, we take you on a quick review at some key characteristics and prior dealings of the man behind the plan - Donald J. Trump.

I. Character & The Art of the Deal - Or Steal?

In Donald Trump's book The Art of the Deal, he says,

In Donald Trump's book The Art of the Deal, he says,

"You can't con people, at least not for long. You can create excitement, you can do wonderful promotion and get all kinds of press, and you can throw in a little hyperbole. But if you don't deliver the goods, people will eventually catch on ..."

Is the Trump Tax Plan a Tax Boondoggle for Billionaires?

Based on recent polls regarding the Trump Tax Plan, it appears the American people are of the opinion that this a very bad deal for them and their children. Perhaps this is why the Donald appears to be rushing through what appears to be one of the greatest tax billionaire boondoggles in modern history, while telling the public that this tax plan isn't good for him ... or his super rich family and friends.

Always Pay Attention to a Person's Integrity or Lack Thereof

To listen to the Donald, you'd think he has always been a champion, if not a living martyr, of the middle and working classes of America. But the facts don't always square with the Donald's narratives. And the Donald, seems never to admit blame. That's why he has continually lashed out at the media who inform the public about him - calling all, but Rupert Murdoch's vast mass manipulation media [Fox News, Wall Street Journal & NY Post], Fake News. Trump and Murdoch live in the Bizarro World, where so much of what they say appears to be the truth turned upside down.

In the graphic at right, I modified Rupert Murdoch's Fox News website front page celebrating the passage of Trump Tax Plan - in which it appears that the bulk of the breaks will go to the super-rich, including the multi-billionaire Murdoch, who is a global propagandist and powerful Trump supporter. I call this Murdoch's propaganda payout and it appears to be HUGE.

Law and Crime, a web magazine funded in part by A & E Network, states in a February 16, 2016 report that Trump was named in at least 169 Federal Lawsuits. They went on to say that,

"The federal lawsuits that we reviewed date back to 1983 and involve everything from business disputes, antitrust claims and, more recently, accusations that Trump's campaign statements are discriminatory against minorities. Some of the cases have been resolved, some were dismissed as frivolous, and others were privately settled. He's been sued by celebrities, personal assistants, prisoners, people in mental hospitals, unions, and wealthy businessmen. Of course, Donald Trump has also done his fair share of suing as well."

Slippery Donald - A Sales Promoter Who Must be Watched Carefully

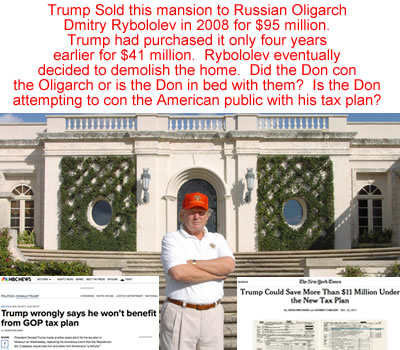

Watching Trump promote and sell his tax plan to the American public reminded me of a report about how the Donald sold a Palm Beach mansion - Maison de L'Amitie at 515 North Country Road - to Russian Oligarch Dmitry Rybolovlev in 2009. In a July 28, 2016 story in Politico, reporter Jose Lambiet says of the deal,

Watching Trump promote and sell his tax plan to the American public reminded me of a report about how the Donald sold a Palm Beach mansion - Maison de L'Amitie at 515 North Country Road - to Russian Oligarch Dmitry Rybolovlev in 2009. In a July 28, 2016 story in Politico, reporter Jose Lambiet says of the deal,

"This is what he [Trump] does with everything. He puts a little veneer on things and he doubles the price, and people buy it," ... "He's [Trump] all smoke and mirrors--and that house was the proof."

Dmitry, the Russian Oligarch, paid $95 million for what Trump had paid only $41 million just four years earlier. Dmitry is now reportedly planning to demolish the mansion.

The question is whether the Donald snuck one by the Russian Oligarch, or whether the Donald is in cahoots with the Russian Oligarchs, and this was an indication of such?

The graphic / photo at right shows Trump standing in front of the Maison de L'Amitie. In the lower left I added his claim that he wouldn't benefit from the Trump Tax Plan as reported by NBC News on November 29, 2017; while in the lower right is a December 22, 2017 New York Times analysis indicating that the Trump Tax Cuts might enable him to take advantage of $11 million in tax breaks.

II. Trump & The Russian Oligarchs

Are These Birds of a Feather Flocking Together?

A July 13, 2017 report by the New Republic informs us that,

A July 13, 2017 report by the New Republic informs us that,

"In 2015, the Taj Mahal [controlled by Donald J. Trump] was fined $10 million--the highest penalty ever levied by the feds against a casino [in years] - and [they] admitted to having "willfully violated" anti-money-laundering regulations."

The report references the book, Red Mafiya, about the rise of the Russian mob in America, by investigative reporter Robert I. Friedman. It appears that the laundered money came from the Russian mob, and further in the story we learn a bit more about what appear to be the Donald's shadowy business dealings with Russia.

"In April 2013, a little more than two years before Trump rode the escalator to the ground floor of Trump Tower to kick off his presidential campaign, police burst into Unit 63A of the high-rise and rounded up 29 suspects in two gambling rings. The operation, which prosecutors called "the world's largest sports book," was run out of condos in TrumpTower--including the entire fifty-first floor of the building. In addition, unit 63A--acondo directly below one owned by Trump--served as the headquarters for a "sophisticated money-laundering scheme" that  moved an estimated $100 million outof the former Soviet Union, through shell companies in Cyprus, and into investments in the United States. The entire operation, prosecutors say, was working under the protection of Alimzhan Tokhtakhounov, whom the FBI identified as a top Russian vor closely allied with Semion Mogilevich. In a single two-month stretch, according to the federal indictment, the money launderers paid Tokhtakhounov $10 million.

moved an estimated $100 million outof the former Soviet Union, through shell companies in Cyprus, and into investments in the United States. The entire operation, prosecutors say, was working under the protection of Alimzhan Tokhtakhounov, whom the FBI identified as a top Russian vor closely allied with Semion Mogilevich. In a single two-month stretch, according to the federal indictment, the money launderers paid Tokhtakhounov $10 million.

Tokhtakhounov, who had been indicted a decade earlier for conspiring to fix the ice-skating competition at the 2002 Winter Olympics, was the only suspect to elude arrest. For the next seven months, the Russian crime boss fell off the radar of Interpol, which had issued a red alert. Then, in November 2013, he suddenly appeared live on international television--sitting in the audience at the Miss Universe pageant in Moscow. Tokhtakhounov was in the VIP section, just a few seats away from the pageant owner, Donald Trump.

After the pageant, Trump bragged about all the powerful Russians who had turned out that night, just to see him. "Almost all of the oligarchs were in the room," he told Real Estate Weekly."

A Tax Plan for the new American Oligarchs?

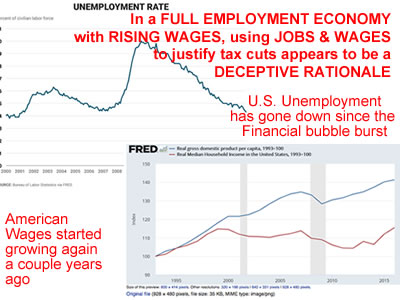

The U.S. has a Full Employment Economy & Wages are Rising

So Why is Trump Promoting Fiscal Stimulus in a Full Employment Economy?

Over the past few years the economy has been steadily adding new jobs, and wages have been rising. The unemployment rate is 4.1%, which means the U.S. is operating in a full employment economy. A full employment economy is defined as one where everyone who wants a job, has one, except those who are in transition. Normal transitioning is generally estimated at 5% of those who are employed. These transitioning unemployed workers are those workers who are making the change from school to jobs or vice versa, switching jobs or careers, moving from one locale to another, or making other relevant job or life changes such as illnesses etc..

Over the past few years the economy has been steadily adding new jobs, and wages have been rising. The unemployment rate is 4.1%, which means the U.S. is operating in a full employment economy. A full employment economy is defined as one where everyone who wants a job, has one, except those who are in transition. Normal transitioning is generally estimated at 5% of those who are employed. These transitioning unemployed workers are those workers who are making the change from school to jobs or vice versa, switching jobs or careers, moving from one locale to another, or making other relevant job or life changes such as illnesses etc..

So given we're in a full employment economy where wages are rising, why are we incurring over $1 trillion in new debt to give the richest people in the nation / world tax breaks? The new jobs, higher wages argument seems deceptive as it just doesn't seem to apply here.

Former NYC Mayor Bloomberg Says "This Tax Bill is a Trillion Dollar Blunder"

Former Republican Mayor Michael Bloomberg wrote an editorial dated December 15, 2017 on Bloomberg.com entitled "This Tax Bill is a Trillion Dollar Blunder".

Former Republican Mayor Michael Bloomberg wrote an editorial dated December 15, 2017 on Bloomberg.com entitled "This Tax Bill is a Trillion Dollar Blunder".

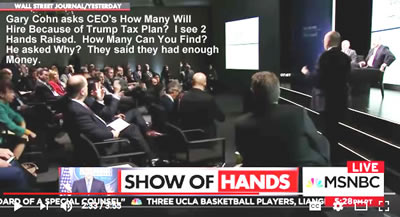

In the editorial Bloomberg cites his rationale, including an anecdotal poll taken by Trump Economic Adviser Gary Cohn who on November 14, 2017 asked CEO's to raise their hands if they planned any additional hiring. In the video of the event I saw only two hands raised, and the moderator goes on to ask, 'Why weren't more hands raised?'. Go to YouTube.com and type in the search 'gary cohn asks ceos to raise hands' to see the video for yourself. The answer is that the top CEO's are sitting on trillions in cash, so a tax break isn't going to change the investment landscape for them with respect to adding jobs.

Bloomberg concluded his editorial with the following statement.

"The tax bill is an economically indefensible blunder that will harm our future."

It's also important to note that since the lows following the Great Recession of 2008 - 2009, wages have been going up between two and four percent, as measured on a quarterly basis.

- CLICK HERE to view the rest of our report on the Trump Tax Plan - Super Rich Bilk Billions from America's Unborn Babies.

Trump Tax Plan: A Morally Bankrupt President's Gift?

Are Billionaires Trump & Murdoch Bilking America's Unborn Babies?

Updated 12/26/17 _ December 19, 2017 / New York City Neighborhoods / New York City Business / News Analysis & Opinion / Gotham Buzz NYC. Continued.

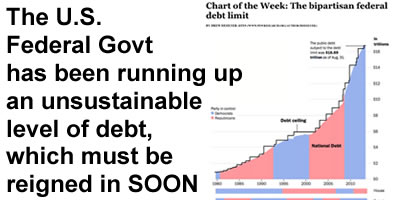

Why are Republicans Increasing National Debt - NOT Reducing it?

Trump Betrays Fiscal Conservatism - Adds $1 - $1.5 Trillion to National Debt

They're Not Giving You Back Your Money Because They Don't Have it - They're Stealing it from Your Children

Trump ran as a fiscal Conservative, telling us that he would pay off the national debt. In an April 12, 2017 interview, Office of Management and Budget Director Mick Mulvaney explained to the Washington Examiner, that Trump's debt pay down promise was hyperbole.

Trump ran as a fiscal Conservative, telling us that he would pay off the national debt. In an April 12, 2017 interview, Office of Management and Budget Director Mick Mulvaney explained to the Washington Examiner, that Trump's debt pay down promise was hyperbole.

"President Trump's campaign promise to eliminate the $20 trillion national debt was hyperbole, his budget director acknowledged in an interview aired Wednesday."

"It's fairly safe to assume that was hyperbole," Office of Management and Budget Director Mick Mulvaney said in an interview with CNBC. "I'm not going to be able to pay off $20 trillion worth of debt in four years. I'd be being dishonest with you if I said that I could."

Are Republicans Phony Fiscal Conservatives & Really Just Shills for the Rich?

While voters likely didn't expect the Donald to pay off the entire debt, few - if any - expected the Donald would promote legislation that increases it.

While voters likely didn't expect the Donald to pay off the entire debt, few - if any - expected the Donald would promote legislation that increases it.

America already has over $20 trillion in debt outstanding. That's roughly an astounding $63,000 per person [not per adult / worker] in a nation where the median annual income is $59,000 per year.

Not raising the debt limit was why Republican House Speaker Paul Ryan and the Republican House nearly brought the United States to the brink of bankruptcy in a standoff with liberal Democratic President Barack Obama back in the Fall of 2013. The debt is much higher than then, and the crisis has passed, so what gives? Was that huge public display of gamesmanship just petty politics?

Trump & Bankruptcies: Defcon Don's Debt Bomb?

It's worth keeping in mind Trump's own experiences in managing his companies' debts. Trump companies declared bankruptcy six times [he counts three of them as one, generally citing only four]. Those huge financial failures are why he reportedly started dealing with the Russians, in what appear to be laundering schemes for the money of the Russian Oligarchs.

Wake Up Call & The Rise of American Oligarchs

The Russian Oligarchs are alleged to have become filthy rich by bilking their own people out of their national wealth through discounted sales of national assets by their 'friends' in Government

Does using the American federal government to borrow money to provide tax breaks which further enrich America's wealthiest billionaires and millionaires - bear any resemblance to what the Oligarchs have done in Russia?

According to a Washington Post report on September 26, 2016,

According to a Washington Post report on September 26, 2016,

"Trump's companies have filed for Chapter 11 bankruptcy protection, which means a company can remain in business while wiping away many of its debts. The bankruptcy court ultimately approves a corporate budget and a plan to repay remaining debts; often shareholders lose much of their equity.

Trump's Taj Mahal opened in April 1990 in Atlantic City, but six months later, "defaulted on interest payments to bondholders as his finances went into a tailspin," the Washington Post's Robert O'Harrow found. In July 1991, Trump's Taj Mahal filed for bankruptcy. He could not keep up with debts on two other Atlantic City casinos, and those two properties declared bankruptcy in 1992. A fourth property, the Plaza Hotel in New York, declared bankruptcy in 1992 after amassing debt.

PolitiFact uncovered two more bankruptcies filed after 1992, totaling six. Trump Hotels and Casinos Resorts filed for bankruptcy again in 2004, after accruing about $1.8 billion in debt. Trump Entertainment Resorts also declared bankruptcy in 2009, after being hit hard during the 2008 recession."

Americans should be wary that Trump doesn't lead what appears to be the spineless Republican Party leadership - and the nation - down the path to bankruptcy because of his reckless fiscal management. It bears mentioning that Senate Majority Leader Mitch McConnell's wife, Elaine Chao, was a formerly on Murdoch's 21st Century Fox News Board and thus it's not improbable that the couple, taken as a unit, has had personal and financial interactions with Rupert Murdoch and his propaganda machine.

Now is a time when we should be reducing debt - not adding to it - and certainly not to borrow more money to give rich people and large corporations tax breaks.

III. Billionaire Trump & Repeal of the Estate Tax

Is 'Don & Friends' Bilking Thousand(s) of Billions from America's Unborn Babies?

The part of the Trump Tax Plan I find most reprehensible is the repeal of the Inheritance Tax [also called the Estate Tax or Death Tax]. Originally the bill proposed doing away with Estate Taxes altogether, but that was modified in the final bill, and they raised the amount of estate wealth not subject to taxes would rise to $11 million per person / $22 million per couple.

The Congressional Budget Office estimates that estate taxes will contribute over $275 BILLION based on current law between 2017 and 2026. That's a Quarter of a Trillion Dollars of lost tax revenue from the richest 0.1% of us.

Stealing from Unborns & Babies to Enrich the Richest

Trump's MAGA Financial Perversion

It seems to me that the heirs of the mega millionaires and mega billionaires already have too much wealth which they have done nothing to earn. Can't they afford to contribute a bit more in taxes on income for which they have done NOTHING? The Trump Tax Plan proposes financing this huge tax revenue loss, by borrowing in the name of America's children, babies and the unborn.

Is this financial perversion really going to Make America Great Again?

Society & Wealth Distribution - Maximize Profits or Maximize Human Potential?

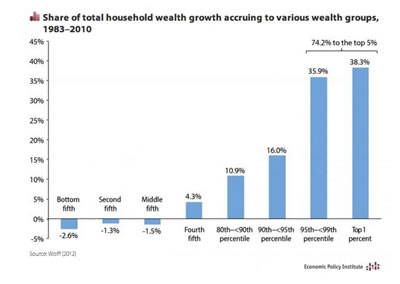

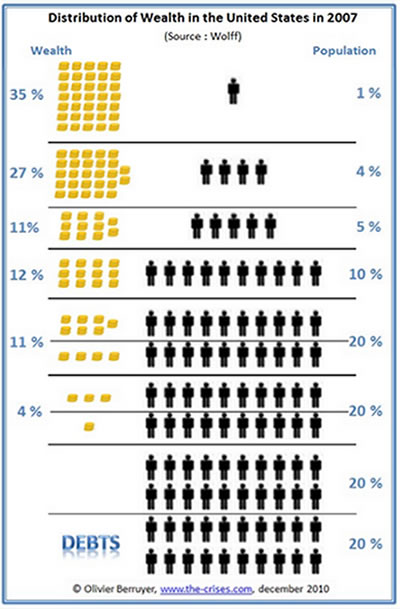

The top .1% owns 20% of everything. This sort of lopsided wealth distribution will, in time, throw us back to feudal times where the population is just trying to get by, while the billionaire Russian and American Oligarchs control all of the wealth.

The top .1% owns 20% of everything. This sort of lopsided wealth distribution will, in time, throw us back to feudal times where the population is just trying to get by, while the billionaire Russian and American Oligarchs control all of the wealth.

To put this in terms an economist understands, underperforming human assets [the rich] will be consuming all of the capital, while the high potential performers - people with intelligence, ambition and energy - will be underfunded. Over time this will leave society to return to the languishing development and virtual standstill in the course of human knowledge of feudal times.

The mantra of capitalism is to maximize profits through innovation and efficiency. The mantra of good government should be to maximize human potential. The more distributed wealth is in America, the greater likelihood that the people who have potential will be able to find a way to fulfill it. This is in part what has made America so prosperous, and the ideals embedded in the U.S. Constitution reflect that understanding by our Founding Fathers.

In America people have a chance to succeed if they are motivated, because families and members can pool their small resources to enable some success. If all the capital is controlled by the few, and the laws are changed willy nilly to suit bloated billionaires like mass media propagandists like Rupert Murdoch, society as a whole, will eventually decay.

A Significant Portion of Estate Tax is Unrealized Capital Gains

A large portion of the Estate Tax comes from unrealized capital gains on stocks, property and other items. According to the Center on Budget and Policy Priorities 55% of estates valued at over $100 million derive their value from unrealized capital gains.

A large portion of the Estate Tax comes from unrealized capital gains on stocks, property and other items. According to the Center on Budget and Policy Priorities 55% of estates valued at over $100 million derive their value from unrealized capital gains.

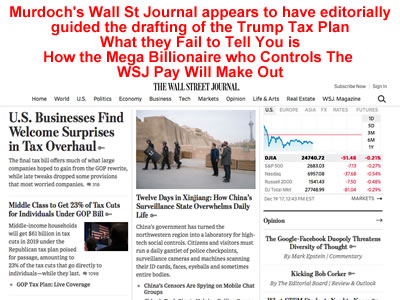

Rupert Murdoch, the man who controls the propaganda machine that put Trump in power, has an estate that is valued at over $14 billion. Most of his wealth comes from stock in his media empires which likely have a HUGE unrealized amount of unrealized capital gains since he assumed control of the company over a half century ago. If they repeal the estate tax, this means that Murdoch and his heirs will escape paying between $3 billion in capital gains on the unrealized gains made over Murdoch's life or $7 billion in estate taxes.

But this isn't the first time Murdoch has appeared to pull the strings on one of his propaganda promoted pols, to enhance his own financial gains. A few years back Murdoch backed the election of one of his former employees - Tony Abbot - to become Australia's Prime Minister. After Abbott became Prime Minister, the Abbott Administration failed to do a timely court filing in connection with an $800 million plus lawsuit against Rupert Murdoch's company. Failure by Abbott to file in a timely manner resulted in a tax rebate to Murdoch's company of the amount, compliments of all of the Australian taxpayers / voters who took Murdoch's media's manipulative advice, and had voted for Abbott. And Murdoch has repeatedly told reporters he's never used his political propaganda machine to further his own economic interests. There's plenty of evidence to the contrary - click here to learn more about Rupert Murdoch / Corruption / Fox Fake News.

Be wary of where you get your information, as billionaire media moguls like Keith Rupert Murdoch, appear not to be out to inform the public, so much as to manipulate them.

So it appears that Trump's Tax Plan has the heirs to the richest people on the planet paying less in taxes on massive sums on unearned income, while the unborn babies, working single mothers, and working class people of all stripes, are put on the hook to make up the estate tax shortfall.

So it appears that Trump's Tax Plan has the heirs to the richest people on the planet paying less in taxes on massive sums on unearned income, while the unborn babies, working single mothers, and working class people of all stripes, are put on the hook to make up the estate tax shortfall.

This just seems to perverse - even for people like Murdoch and his propaganda supported pol, Donald Trump - both of who seem to have no moral compass at all.

The Realities of the Estate Tax

Currently there isn't any tax on estates valued at $5.45 million per person or $10.9 million for a couple. Few people accumulate that level of wealth over their lifetimes, as evidenced by how few returns involve paying estate taxes.

According to the Tax Policy Center, a non-partisan Think Tank in Washington D.C., there were only 9,500 Estate Tax returns filed in 2011 out of an estimated 2,500,000 deaths that same year. Of those who filed, only 4,400 estates were taxable.

I found a report by the Tax Center on Budget and Policy Priorities, that references the Tax Policy Center research which tells us,

"that in 2013, the effective tax rate -- that is, the share of the estate's value paid in taxes -- was 16.6 percent, on average ... that is far below the top statutory rate of 40 percent."

Billionaire Murdoch's Fox News Propagandistic Narratives

Former Murdoch WSJ Reporter Touts Jobs, Jobs, Jobs - But We're Already in a Full Employment Economy where Wages are Rising

While you read what follows, bear in mind that we have a full employment economy and wages have been rising for a number of years.

In an April 16, 2015 report on Fox News, former WSJ reporter Stephen Moore, makes the following claim.

In an April 16, 2015 report on Fox News, former WSJ reporter Stephen Moore, makes the following claim.

"That $12.7 billion collected is out of $2.8 trillion in total federal revenue in 2013. In other words, a trivial 0.5 percent of federal tax receipts now come from estates. Get rid of the tax and the government still raises 99.5 percent of its money -- at worst. A study by Steve Entin of the Tax Foundation estimates that because the tax reduces capital investment and savings, the impact of the tax on federal revenues may even be negative over time."

Stephen must be a very wealthy man to dismiss $12.7 billion per year of annual income as a pittance. That's nearly the entire Gross National Product of the country of Jamaica. And his claim that continuing to tax the estates of the wealthiest "may even be negative over time", is unproven. I have never known a wealthy person not willing to borrow money if they found a good investment, nor one who runs out to spend fresh money if there's not a good place to invest it. As noted above, Trump Economic Adviser Gary Cohn found that out when meeting with CEO's on November 14, 2017.

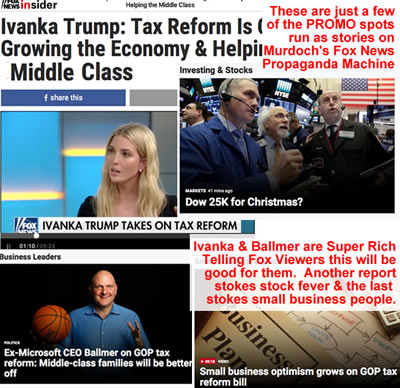

In the graphic at right, Ivanka Trump who with her husband, has a reported net worth nearing $1 billion, and Steve Ballmer who is a Microsoft multi-billionaire - tell Fox News viewers how good the Trump tax plan will be for Fox News viewers. Murdoch, who controls Fox News, the WSJ & NY Post and is also a multi-billionaire, published and broadcast a steady stream of promotional stories in favor of the plan, telling Fox News, Wall St Journal and NY Post viewers and readers, that the Trump Tax Plan would be good for the people in the audience. But what all of these super-rich tax plan PROMOTERS DON'T TELL those who are watching, is THAT the plan is DISPROPORTIONATELY GOOD FOR THEM.

Keep in mind that people don't become Super Rich by helping others. They become Super Rich by helping themselves.

Voting audiences need to pay closer attention to who's going to benefit the most, and question the true motives and veracity of the people who tell their audiences - who are getting the crumbs - how well the crumb-eaters will make out.

Murdoch's Fox Fake News Narratives

NY Post Reports Estate Taxes are Killing Family Farms

In a December 4, 2017 report in the NY Post headlined, 'Lawmaker: Ending the Estate Tax - Rewards Those who are Not Wasting Their Money on Booze or Women'. Murdoch's propaganda paper provides some context on the estate tax which they obtained from the Des Moines Register and Associated Press, but they repeat parts of this quote above from Republican Senator Charles Grassley in the article, and the story ends with this Grassley quote.

In a December 4, 2017 report in the NY Post headlined, 'Lawmaker: Ending the Estate Tax - Rewards Those who are Not Wasting Their Money on Booze or Women'. Murdoch's propaganda paper provides some context on the estate tax which they obtained from the Des Moines Register and Associated Press, but they repeat parts of this quote above from Republican Senator Charles Grassley in the article, and the story ends with this Grassley quote.

"It's getting harder all the time to have a family farm or family-run business," Grassley said in a statement in January. "Congress ought to do everything possible to encourage family enterprises to stay in operation and get next generations involved."

A story on Fox Business on November 27, 2017 also provides some context, but again ends their report with the Murdoch mantra tagline implying the estate tax isn't any good.

"It's a stupid tax," said Edward McCaffery, a professor of law, economics and political science at the University of Southern California. "In real comprehensive tax reform there has to be something sensible, including a sensible way to tax the rich."

What the Murdoch mouthpieces don't tell you is that their boss is 86 years old [but whose mother lived to age 103] and he has at least $14 billion in assets he wants to turn over to his heirs ... tax free? That would be billions of dollars going straight to the family of the propaganda boss, compliments of the taxpayer, and thanks to the people who vote for Murdoch propaganda machine promoted pols.

In the graphic at right I modified the NY Post front page from what appeared to be a Trump Tax package promotional piece, to what I surmise they're really thinking. That's Fox News, WSJ & NY Post Chairman Rupert Murdoch in the lower left corner wishing everyone a culturally pandering MERRY XMAS - NOT HAPPY HOLIDAYS.

Murdoch's Fox News - Converting Cultural Pandering into Cash?

Murdoch's Propaganda Machine Appears to Use the Culture Wars to Manipulate Their Audiences to Vote in Favor of the Billionaire's Candidates & Financial Interests - NOT THEIR OWN

Murdoch's audiences appear to be culturally coopted by Fox commentators like Scam Hannity, who take meaningless positions defending their Christmas greeting, in what seems to be a manipulative ploy. Hannity and Murdoch then appear to guide their audiences into voting for pols who enable them to cash in their audience influence with pols, at the proverbial legislative bank.

Murdoch's audiences appear to be culturally coopted by Fox commentators like Scam Hannity, who take meaningless positions defending their Christmas greeting, in what seems to be a manipulative ploy. Hannity and Murdoch then appear to guide their audiences into voting for pols who enable them to cash in their audience influence with pols, at the proverbial legislative bank.

Take note that these two hucksters [mega millionaire & mega billionaire] are likely to reap mega millions - if not billions in compensation and / or tax breaks - for what seems their role in promoting all things Trump, while discrediting all things against Trump. Often enough Scam Hannity and other Murdoch Mouthpieces appear to provide reports that ignore known facts and / or our nation's system of due process.

Meanwhile the American children and grandchildren of Murdoch's audiences - will be on the hook for an additional $1.5 TRILLION dollars in added U.S. government debt - thanks to their parents' and grandparents' gullibility. If you love your children, you will begin paying closer attention to what these people are doing - versus what they are telling you. And you will rely on multiple information sources - not just those that may reinforce your cultural point of view. As all adults know, sometimes the truth is difficult to swallow.

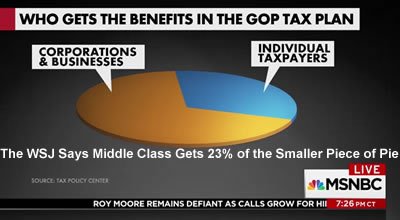

In the graphic at right, billionaire Rupert Murdoch's Wall St Journal tells business how great the Trump Tax Cuts will be for them, while releasing the truth that the middle class will only get 23% of the TAX CUTS FOR INDIVIDUALS [not including all of the corporate breaks that largely go to the wealthiest] in 2019.

Founding Father President Thomas Jefferson said,

Founding Father President Thomas Jefferson said,

"Those that believe a people can be ignorant and free. Believe in something that never was and never will be."

Family Farms do not Appear to be Lost due to Estate Taxes

The Tax Policy Center notes that about 90% of the farms are small, bringing in less than $350,000 in annual revenue and having estate valuations of less than $1 million for the median farmer in 2015. In 2016 estate taxes affected only 682 farmers out of the total population of 2.1 million family farms. This means their farms were valued at more than $5.45 million for an individual, or more than $10.9 million for a couple. For many farm owners, the farm was only a portion of their assets.

Family Farmers Tax Policy Allows Generous Tax Payment Plan

The U.S. federal government has made generous special tax provisions to help families retain their farms. In an October 10, 2017 report in CNN's Money Magazine, notes,

"In cases where estate tax is owed, normally it's due within 9 months from the date of death. But family members who inherit a farm and plan to continue running it are allowed to take 15 years to pay it if the farm assets make up 35% or more of an estate's value. What's more, the heirs may choose to only pay interest on the tax due in the first four years ..."

Murdoch's Fox News - Failure at Full Disclosure?

Murdoch Recently Purchased a Vineyard & Trump Gives Vineyards Tax Breaks

Trump backer and multi-billionaire global propagandist, Keith Rupert Murdoch recently bought a vineyard in Bel Aire, California [2013]. Murdoch's $29 million vineyard / farm would be miniscule in his estate. But it's worth noting the great coincidence that the Trump Tax Plan includes further tax breaks for vineyard owners.

Trump backer and multi-billionaire global propagandist, Keith Rupert Murdoch recently bought a vineyard in Bel Aire, California [2013]. Murdoch's $29 million vineyard / farm would be miniscule in his estate. But it's worth noting the great coincidence that the Trump Tax Plan includes further tax breaks for vineyard owners.

Murdoch has likely been the biggest winner of Trump's first year in office through Federal Communications Commission changes, disruptive changes in law enforcement agencies that have been pursuing possible lawbreaking by Murdoch's corporation, and major big bucks bonanza tax breaks that oh, so coincidentally apply to Murdoch.

Trump appears to be moving so fast on what appears to be the Murdoch propaganda payout agenda, that Murdoch may even be able to dump Trump with no downside before the next election cycle [I hear tell he likes Disney CEO Iger]. This is likely to happen, especially if the baggage Trump has been so rapidly accumulating, becomes too burdensome for the billionaire propagandist to risk with his audience.

Murdoch has dumped countless people he once supported in the past, including former British Prime Minister David Cameron and Fox News Chairman Roger Ailes in 2016, and former Fox News propagandist Bill O'Reilly in 2017. The photo at right shows Rupert Murdoch and his vineyard in a May 13, 2013 report in Business Insider.

Is this the vicious plan, of a couple of morally bankrupt billionaires, and is stealing the birthright of America's children really going to Make America Great Again?

IV. How Deceitful the Donald?

Sells Repatriation Tax Reduction with Unsupported Jobs Claims

This section of the Tax Bill calls for reduced tax rates on profits [low tax rates of about 5 to 15%] made and held by American corporations overseas. Like a lot of the Trump Tax Reform Bill, it's being sold and packaged with unadulterated bullshit - aka telling us this will bring more and better paying jobs based on their [lack of] integrity, not on the facts.

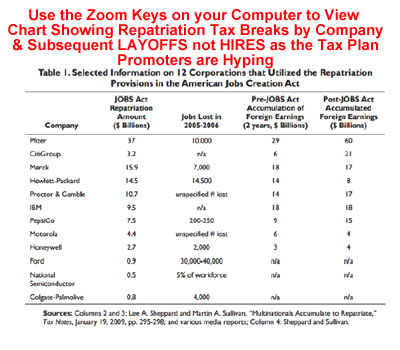

We also have some history we can learn from regarding this part of the tax package, as George W. Bush - our last 'great' president - included this same sort of corporate tax relief in a tax bill passed by his Administration in 2004. In a U.S. Treasury report dated 3/23/2011 entitled Just the Facts: The Costs of a Repatriation Tax Holiday Michael Mundaca informs us,

We also have some history we can learn from regarding this part of the tax package, as George W. Bush - our last 'great' president - included this same sort of corporate tax relief in a tax bill passed by his Administration in 2004. In a U.S. Treasury report dated 3/23/2011 entitled Just the Facts: The Costs of a Repatriation Tax Holiday Michael Mundaca informs us,

"Although advocates argue that a repatriation holiday could be costless or even raise tax revenue, the official Congressional scorekeeper, the Joint Committee on Taxation, estimated before enactment that the 2004 repatriation holiday would actually cost billions of dollars. In 2009, when this idea was being pushed once again, Senator Baucus indicated during Floor debates that the cost of a new holiday had increased to $30 billion, presumably because a second holiday would encourage further erosion of the U.S. tax base through shifting of profits overseas [Editor's Note: they would shift profit overseas to wait for the next tax holiday]. Moreover, according to outside estimates, just five firms got over one-quarter of the tax benefits of the repatriation holiday, and just 15 firms got more than 50 percent of the benefits. To pay for giving this large tax cut once again to a small group of U.S. companies without increasing the deficit, we would have to raise taxes on other U.S. businesses.

In assessing the 2004 tax holiday, the nonpartisan Congressional Research Service reports that most of the largest beneficiaries of the holiday actually cut jobs in 2005-06 - despite overall economy-wide job growth in those years - and many used the repatriated funds simply to repurchase stock or pay dividends. Today, when U.S. corporations have ready access to cash they have accumulated and are holding here in the United States, it is even harder to make the case that a repatriation holiday will unlock new investment and job creation."

There's a key point here that is worth highlighting. That the companies that benefitted most from this tax cut - which was sold to the American public purporting to boost jobs - actually cut jobs.

An August 31, 2017 report by CNBC tells us,

"From 2005 to 2006, Pfizer, which repatriated $37 billion, slashed 10,000 jobs. Merck, which brought back $15.9 billion, cut 7,000 jobs, and HP pared its employment rolls by 14,500 after repatriating $14.5 billion."

And they state,

"Congressional Research Service, Congress' nonpartisan think tank, said in a report. The think tank cited a series of reports into the benefits of repatriation, with a common theme that the 2004 program was "an ineffective means of increasing economic growth."

And I have to ask again WHY are they pushing the jobs creation narrative when we're operating in a full employment economy?

And I have to ask again WHY are they pushing the jobs creation narrative when we're operating in a full employment economy?

CNBC started their report with the following summary,

"A similar effort more than a decade ago provided a nice windfall for firms, which then passed along most of it to shareholders in the form of share buybacks and dividends. The effort provided little in the way of hiring and in fact saw some of the beneficiaries actually cut payrolls."

This report aligns with what the U.S. Treasury reported. And it's at total odds with what appears the deceitful sales pitch of the Trump Administration and the Republican Party leadership.

Murdoch's Fox Fake News Full Disclosure Omissions

21st Century Fox & Newscorp Repatriation Tax Example

Needless to say, Rupert Murdoch's global empire probably has quite a bit of off shore profit as it operates in nations around the world. The Murdochs are in the midst of working on a number of huge deals, so it's not unfathomable to think that they may need to repatriate their overseas profits to complete the transactions.

While I could not find any revenue broken out by geography - which may be because they've hidden it so well, or possibly there's a potential SEC 10K reporting violation - my guesstimate is that Murdoch's companies derive half of their revenue outside of the U.S., which on an annual basis is tens of billions [$30 billion give or take] of dollars per year.

Murdoch may also be contemplating other deals under the new deregulated Trump FCC.

V. Is Trump Destroying Democracy by Financially Undermining it?

Reduces Corporate Tax Rates from 35% to 21%

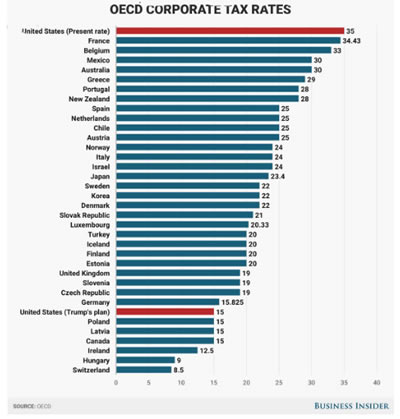

The Trump Tax plan also says they want to reduce America's corporate tax rate because it's not competitive. While America's official top corporate tax rate of 35% is at the high end of the spectrum - few if any corporations pay it. Why? Because of all of the deductions built into America's tax code.

The Trump Tax plan also says they want to reduce America's corporate tax rate because it's not competitive. While America's official top corporate tax rate of 35% is at the high end of the spectrum - few if any corporations pay it. Why? Because of all of the deductions built into America's tax code.

The Organization for Economic Cooperation and Development [OECD] put together an analysis comparing the relative REAL corporate tax rates of 31 of the top economies in the world. The United States is #30 of 31. This contradicts the Trump and Fox News narratives that the U.S. is not competitive on taxes- like a lot of the misinformation in the Trump Tax Plan sales pitch. But this should come as no surprise, as Dishonest Donald has allegedly welched on hundreds of deals, and in an exchange with CBS News on May 1, 2017 John Dickerson asked Trump about his claim that Obama wiretapped him.

"[Dickerson] But you stand by that claim about him [Obama]? [Trump] "I don't stand by anything."

Do Murdoch and Trump want to start an international tax bidding war to the bottom, in order to gut western democracies of their ability to enforce laws, protect their people with due process and govern their nations by rule of law? A lot of nations around the world appear to have fallen prey to the predatory practices of powerful, amoral men who will stop at nothing to make more and more money and power - like drug addicts in pursuit of an endless fix - like Keith Rupert Murdoch and Donald J. Trump.

Africa and parts of the Middle East are the most obvious examples of nations not in control of their own government, pols and policies. By financially crippling or bankrupting a nation's government, billionaires and propagandists will have free reign. Murdoch seems to have this sort of free reign in Australia. As mentioned above, Murdoch appears to have promoted a former employee into the position of Australian Prime Minister [Tony Abbott], who subsequently failed to complete a court filing on behalf of the Australian people vis a vis Murdoch's Newscorp, which cost the Australian taxpayers over $800 million that went into Murdoch's company's pocket.

This scenario is very much like those captured in George Orwell's Animal Farm where the [tax] laws applying to the 'barnyard animals' were vastly different from those that apply to the 'ruling pigs'.

VI. Donald the Divider?

Politicizes Tax Policy Pitting Red States Against Blue

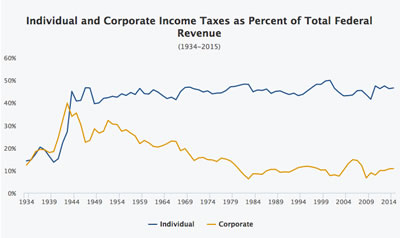

The chart trendline, below right, shows the percent that corporations and individuals paid in federal taxes ending in 2015. These are the two primary sources of tax revenue in the U.S.. Corporate taxes represented about 11% or over $419 billion, while individual taxes represented about 49% or $1.79 trillion. Trump's Tax Plan reduces corporate taxes - already a low share vis a vis history - even more.

In the 2016 campaign, Trump's claim of a rigged system resonated with voters. But what the Donald didn't tell us - is that he was going to rig it even more in his and other billionaires' favor. If that surprises you, then you are probably getting too much of your information from one or more of Rupert Murdoch's propaganda machine outlets, which include Fox News, the NY Post, the WSJ, the Times of London [UK], The Sun [UK] or The Australian.

In the 2016 campaign, Trump's claim of a rigged system resonated with voters. But what the Donald didn't tell us - is that he was going to rig it even more in his and other billionaires' favor. If that surprises you, then you are probably getting too much of your information from one or more of Rupert Murdoch's propaganda machine outlets, which include Fox News, the NY Post, the WSJ, the Times of London [UK], The Sun [UK] or The Australian.

The Donald appears to have won the presidency by taking divisive stances, most of which are the stances he has continued to promote since he assumed office. This has some similarities to Trump's propaganda patron, as Murdoch appears to have been racializing, sensationalizing, politicizing and sexualizing stories with his propaganda media outlets over decades.

Since coming to the national political stage, Trump has railed against minority immigrants like Mexicans and Muslims, and railed against minorities by trying to shout down Black Lives Matter / NFL protesters. All this, while appearing to tacitly support the KKK and Neo Nazis, by adopting a 'neutral' stance. Often enough Murdoch's Fox News, NY Post and Wall St Journal's treatment of Trump's antics, also seem tacitly supportive - if not outright supportive.

Trump has also been involved in a battle of the sexes, which exploded with publication of the 'pussy grabbing' tape in the Fall of 2016, and continues owing in part to the diminished female representation in his Cabinet.

Dividing to conquer, is a strategy long employed in warfare, and Russia has allegedy done just that by meddling in our elections.

Trump appears to be continuing on this democracy destructive path, by politicizing tax policy which discriminates against the blue states. One of Trump's efforts to rally his base, which Murdoch's Wall Street Journal heralded early on, is to eliminate the deduction of taxes by other government bodies [state, local and municipal] on one's federal tax return. To hear some of Trump's and Murdoch's manipulative mass media narratives, you might conclude that the blue states were pulling a fast one on the red states. But like many of these two billionaires' narratives, the truth is nearly the opposite of what they say [media diversity / nothing for self].

Blue States Generally Contribute More to Federal Coffers Than They Receive

Red States Generally Receive More from Federal Coffers Than They Contribute

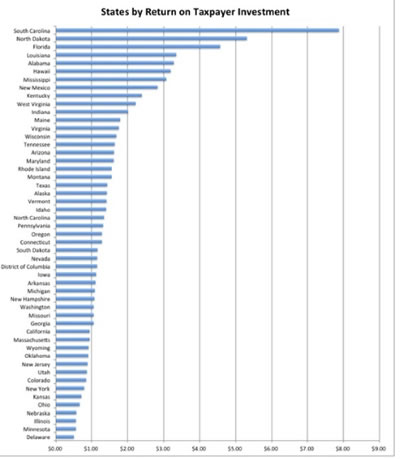

I took a look into what states paid in federal taxes versus what they received and the result shows the red states are the takers / net recipients, while the blue states are the givers / payors [see chart at right complied by The Atlantic in a May 5, 2014 story].

I took a look into what states paid in federal taxes versus what they received and the result shows the red states are the takers / net recipients, while the blue states are the givers / payors [see chart at right complied by The Atlantic in a May 5, 2014 story].

You can use your zoom key to read the states, but essentially South Carolina, North Carolina, Florida,Louisianna, Alabama, Hawaii and Mississippi top the list in that order as net receivers of federal spending. From the bottom of the list and moving up are Delaware, Minnesota, Illinois, Nebraska, Ohio, Kansas, New York and Colorado who are net contributors to the federal budget vis a vis what they receive in return.

Do the red states really want to support the Donald in creating an environment that pits the receiving states against their benefactors? It's a bit akin to biting the hand that feeds you. Trump appears to be employing a Divide & Conquer strategy that pits countryman against countryman. Is this something that Murdoch and the Russian Oligarchs are provoking?

Experience shows us that people at the top, who intentionally divide us, are manipulators in pursuit of their own agenda. Adolph Hitler is one of the most obvious examples. Vladimir Putin in Russia is another. Lincoln and Kennedy may have divided us in pursuit of a higher purpose [freedom & equality], but not before exploring other options in order to avoid pitting us against one another.

Is Trump a Trojan Horse?

The Donald appears to be trying to divide Americans to serve his own selfish goals. He seems to be an anarchistic democracy destroyer who seems to have no moral compass at all.

Please pay close attention to what is happening on the national stage. This Tax Plan gives most Americans a few crumbs, while providing millionaires and the Billionaire Oligarchs tens of thousands, to tens of millions on up in new money. According to a December 22, 2017 NYT analysis based on Trump's most recent publicly available tax return [2005], Trump will get an $11 million tax break after claiming he wouldn't benefit from the plan.

Please pay close attention to what is happening on the national stage. This Tax Plan gives most Americans a few crumbs, while providing millionaires and the Billionaire Oligarchs tens of thousands, to tens of millions on up in new money. According to a December 22, 2017 NYT analysis based on Trump's most recent publicly available tax return [2005], Trump will get an $11 million tax break after claiming he wouldn't benefit from the plan.

The Trump Tax Plan is strikingly analogous to the pigs of Orwell's Animal Farm who rolled out a new program / plan where they hoarded all the goodies for themselves. It's not unreasonable to ask whether our democracy is currently under siege by a Russian-influenced Trojan horse - our own President - Donald J. Trump.

We the People must start getting paying closer attention to what the officials in government are doing - so when they come around to tell you all the wonderful things they've done for you - you'll also be knowledgeable about all of the things they've done to you. And a corollary to this - is to be careful of the information sources you use / trust - as decades and century old media brands have been purchased by billionaires, who now appear to be using mass media to manipulate public opinion in order to enrich themselves - not inform the public.

Best wishes for Happy Holidays, Merry Christmas and best wishes in the New Year.

Gotham Buzz Voluntary Subscriptions

We work very hard to help keep you informed by providing you with independent news coverage, as well as  information about events in the arts, culture and business in the borough.

information about events in the arts, culture and business in the borough.

You can help us continue to provide you with independent, first-person, fact-based, contextural reporting by purchasing an annual subscription. As it's voluntary, there are a variety of price options, one of which should fit within your budget.

Thanks for your encouragement & support.

NYC Boroughs - New York City

NYC Neighborhoods - New York City Related Info

Click this link for promotions, discounts and coupons in New York City.

Click here to go to the NYC Arts & Culture section of this site.

Click these links for promotions by advertisers in Manhattan.

Click this link to go to the NYC Neighborhoods section.

Site Search Tips. 1) For best results, when typing in more than one word, use quotation marks - eg "Midtown Neighborhood". 2) Also try either singular or plural words when searching for a specific item such as "gym" or "gyms".

$element(bwcore,insert_search,N)$

Click this link to the Gotham Buzz front page.

$element(adman,groupads,Sectional2 Ad)$

Click the log in link below to create an ID and post an opinion.

Or send this story to a friend by filling in the appropriate box below.

NYC Related Links

Click for NYC Restaurants NYC.

Click for NYC Shopping NYC.

Click for Things To Do NYC - Holidays in NYC.

Click for NYC Neighborhoods NYC.